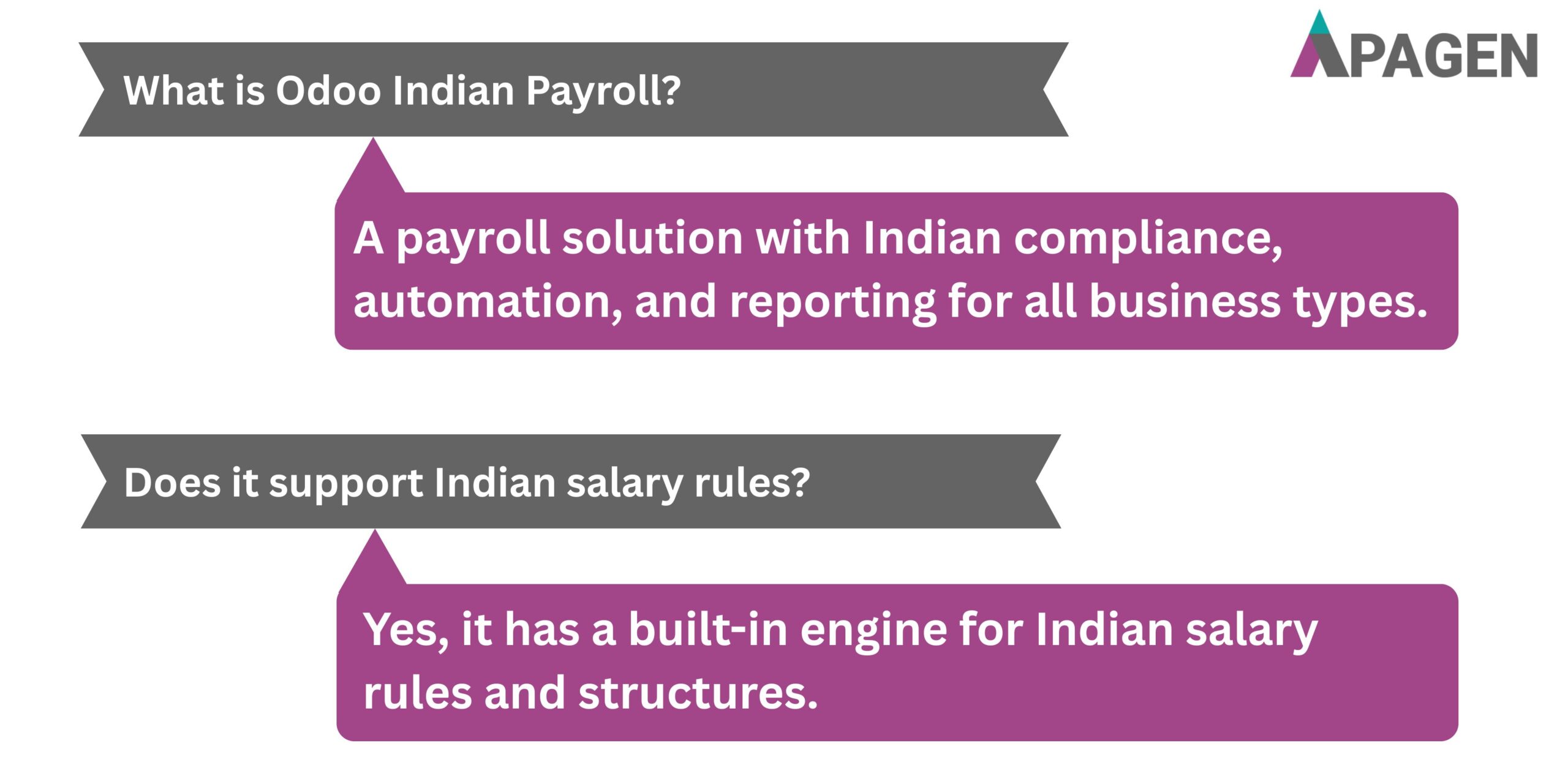

Comprehensive odoo indian payroll software available with all compliance’s, reports and for all kinds of businesses.

Key Features of Odoo Indian Payroll Software

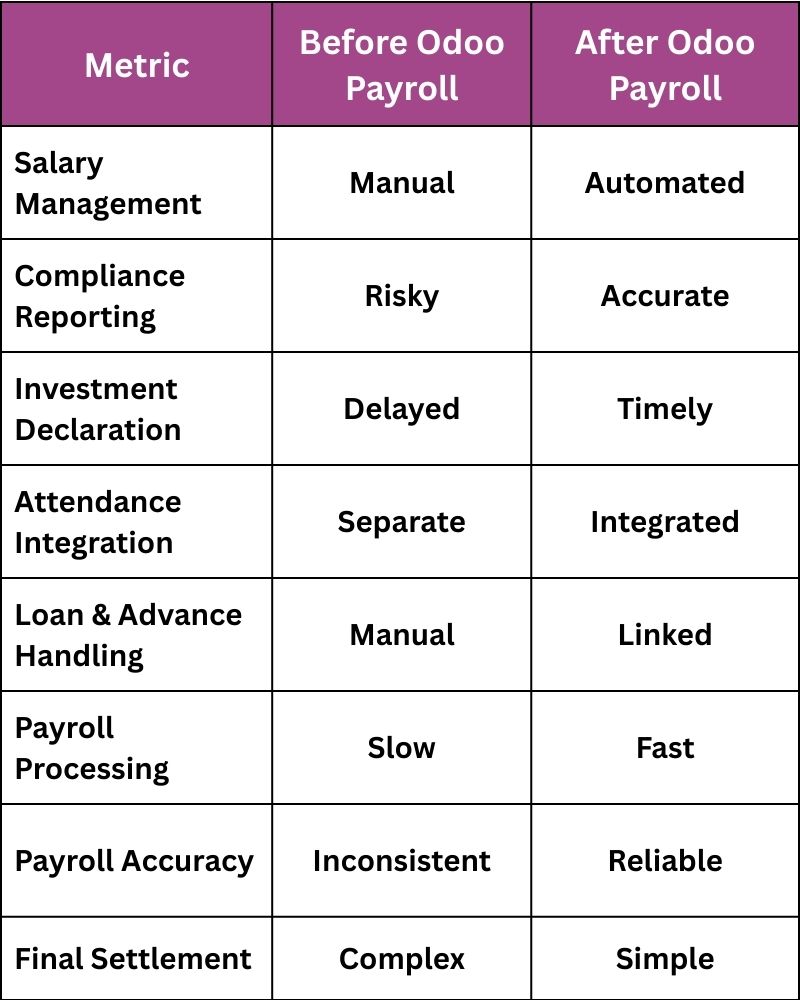

- Innovative Salary Structure – Robust in-built engine to manage Indian Salary Rules and modify current rules to generate new structures on the fly.

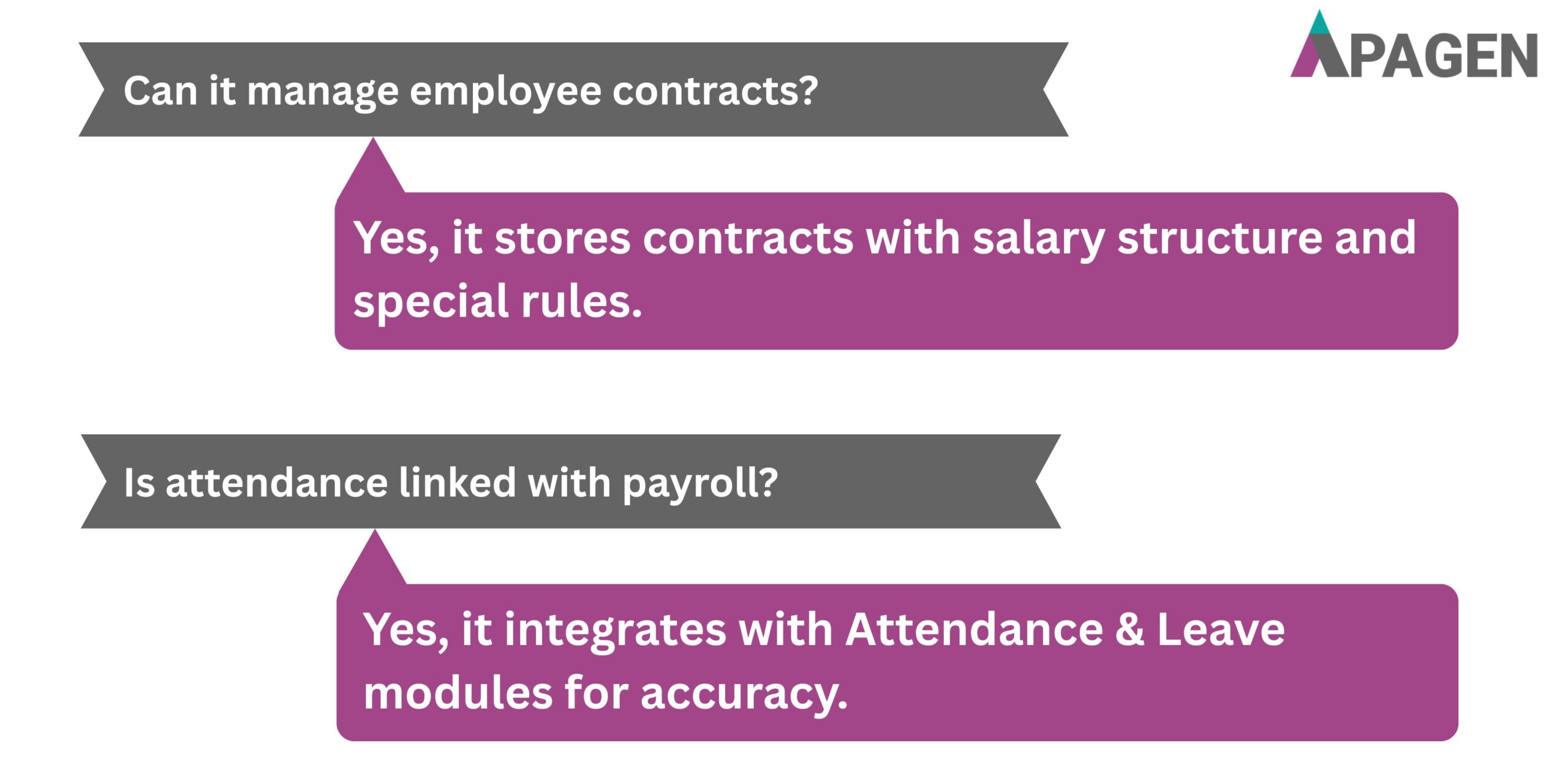

- Contract Management – Manage Employee Contracts to capture Employee’s Salary Structure, Special Rules and attributes directly linked with employee.

- Investment Declaration – Employee can declare their investment at the start of the year and review and update before close of the year to generate accurate TDS deduction in their payslips.

- Integrated with Attendance & Leave – Seamlessly integrated with Attendance & Leave Management module to fetch paid days and leave encashment amounts

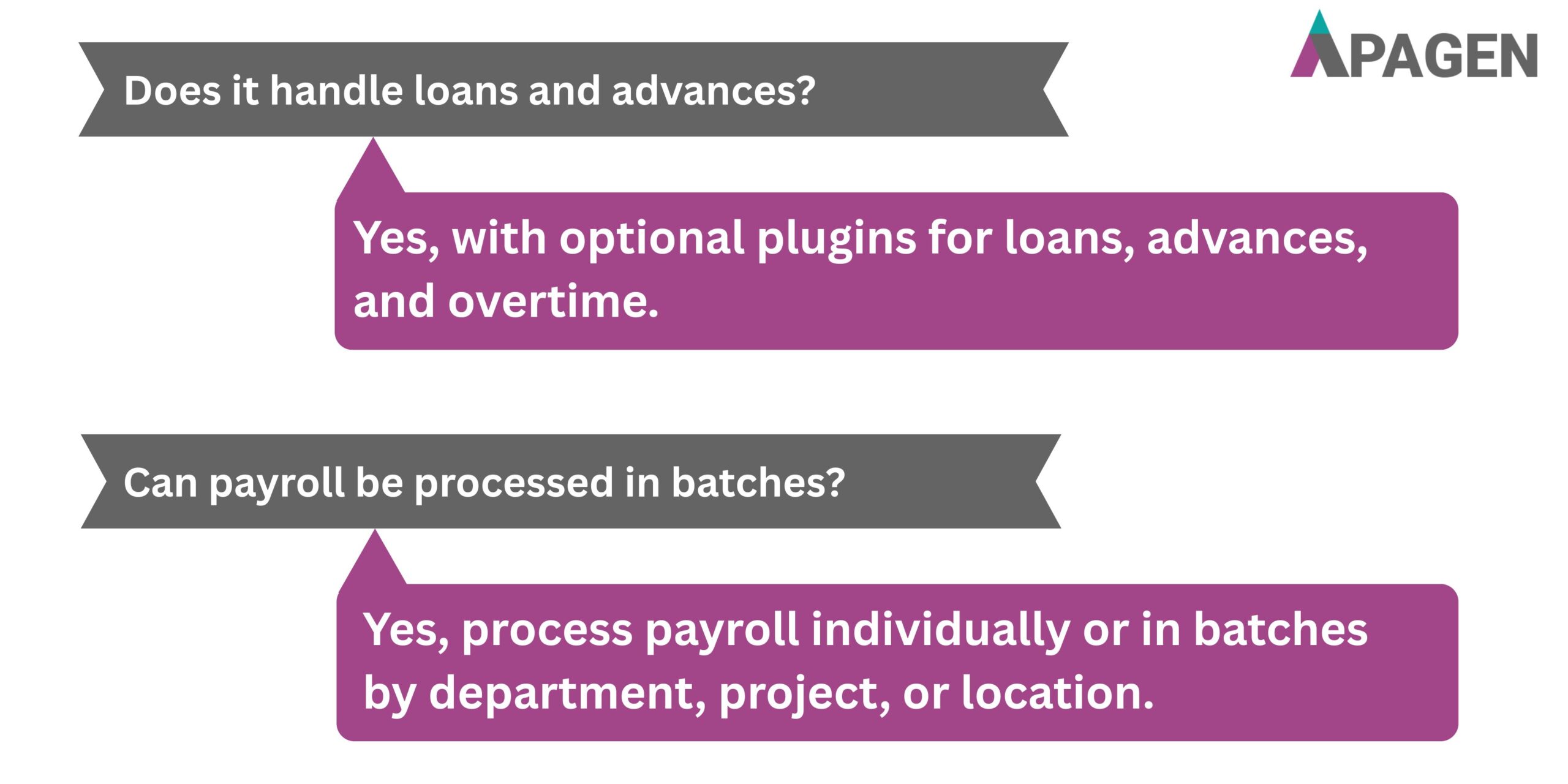

- Loans, Salary Advance & Overtime – Optional Plugins available to manage loan, salary advance or overtime and directly integrated with payroll to account for them in payslip.

- Flexible Payroll Processing – Process payroll either by batch or individually as per choice. Batches can be generated based on departments, projects or locations.

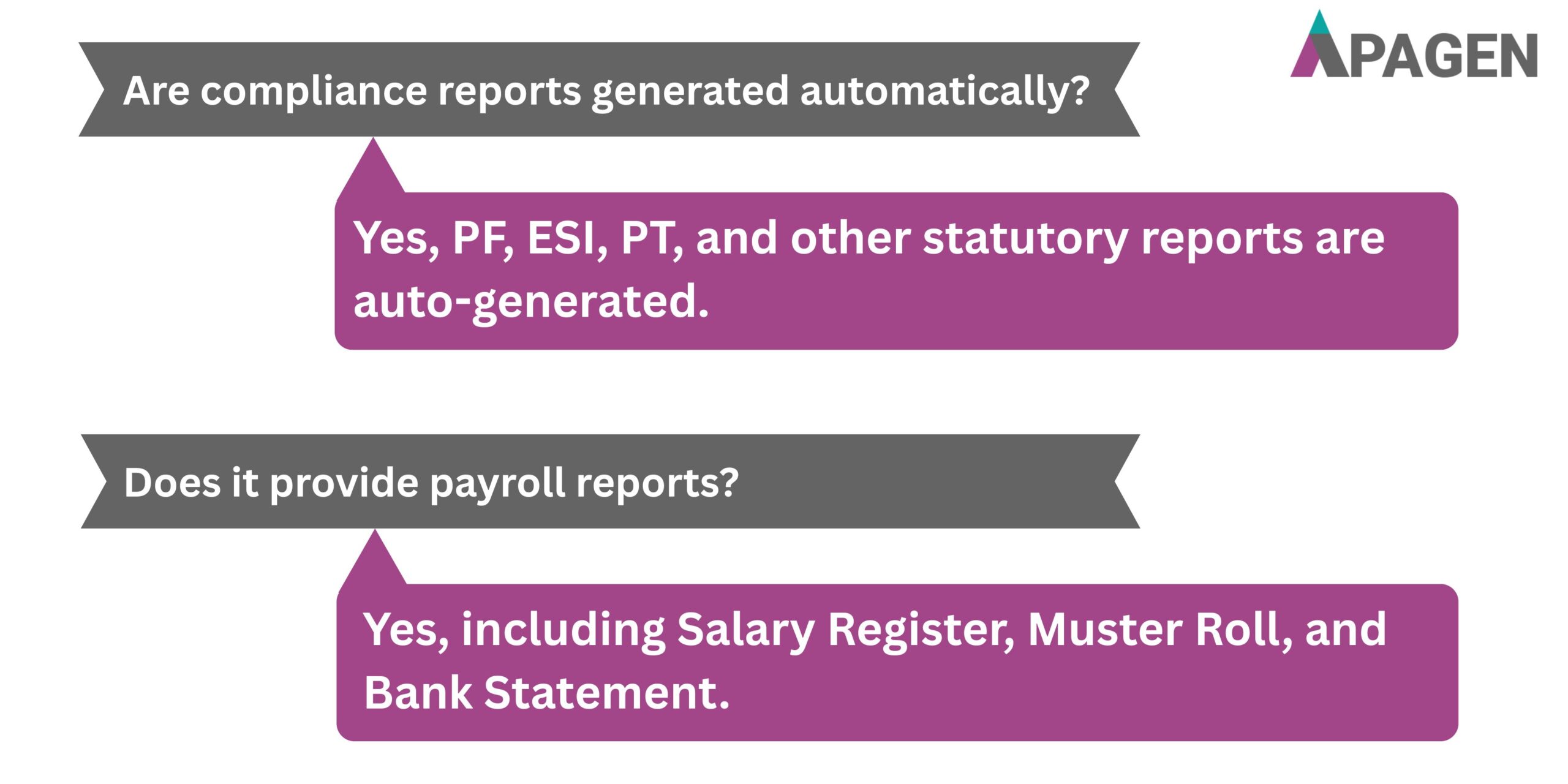

- Payroll Compliance – Generates all your necessary statutory reports required in India such as Provident Fund, Employee State Insurance, Professional Tax, Labour Welfare Funds, etc.

- Payroll Reports – Get flexible payroll reports to analyse payroll with department, allowances, deductions, period like Muster Roll, Salary Register, Bank Statement, etc.

- Full & Final Settlement – It computes for you a whole lot of things which an employee is entitled to receive when he/she is leaving the company that include

- Unpaid salary

- Yearly bonus

- Reimbursement balance

- Gratuity

- Leave encasement

Alerts & Notifications – Get timely alerts and notifications for urgent activities, follow-ups, MIS reports.

I Want Demo